Platinum Lending

Your One-Stop Mortgage Shop

Whether you're buying your first home, refinancing, or exploring flexible loan options — we’re here to guide you every step of the way.

About Us

Where Business Is Done the Right Way

With over 25 years of combined industry experience, Platinum Lending is proud to serve individuals and families throughout Michigan with expert mortgage guidance and unmatched customer care.

As a licensed mortgage broker, we don’t just push products — we find the right mortgage solution for your unique situation. Whether you’re a first-time homebuyer or self-employed with non-traditional income, our team is here to help you feel confident and supported from start to finish.

We’re committed to clear answers, fast service, and real results — because you deserve a lending partner that puts you first.

Why choose us?

Where Business Is Done the Right Way

Home Purchase

Refinance

Loan Options

Client Satisfaction

Personalized Solutions

Exceptional Customer Service

Your Journey to Homeownership Starts Here

we simplify the journey to homeownership. Our dedicated team is here to guide you through every step, providing expert advice and personalized support. Together, we’ll turn your dream of owning a home into reality!

what we offer ?

Effortless Mortgages, Realize Your Dreams

Qualified Mortgages

We offer a full range of conventional and government-backed mortgage options designed for borrowers with standard income and credit profiles. From FHA and VA loans to fixed and adjustable-rate mortgages — we help you choose what’s best for your goals.

Non-Qualified Mortgages

Have unique income or credit circumstances? Our Non-QM loan programs include bank statement loans, investment property financing, and even cryptocurrency-based income solutions. Perfect for business owners, freelancers, and others with alternative income sources.

Expert Customer Care

At Platinum Lending, we go beyond paperwork. Our mission is to make sure you feel informed, secure, and empowered. Every question gets answered, every detail is handled — because your peace of mind matters.

Book a consultation

Partnering in Your Financial Success

Testimonials

Frequently Asked Questions

What’s the difference between a mortgage broker and a direct lender?

A mortgage broker like Platinum Lending acts as a middleman between you and multiple lenders. We don’t fund the loan ourselves — instead, we help you find the best loan options based on your financial situation. This gives you access to more choices and often better rates than working with a single lender.

What is a Non-Qualified Mortgage (Non-QM)?

A Non-QM loan is for borrowers who may not meet traditional lending requirements — like self-employed individuals, freelancers, or those with complex income sources. These loans use alternative documentation such as bank statements, 1099s, or even cryptocurrency income to verify your ability to repay.

How long does it take to get approved?

The timeline can vary based on your situation, but pre-approval can often be completed within 24 to 48 hours. Final approval and closing typically take 20 to 30 days, depending on the loan type and how quickly documents are submitted.

Do I need perfect credit to qualify?

Not at all. We work with many lenders who offer programs for buyers with less-than-perfect credit. Even if you've been turned down elsewhere, we may still be able to help you qualify for a mortgage that fits your needs.

Your One-Stop Mortgage Shop

Helping You Move Forward with Confidence

quick info

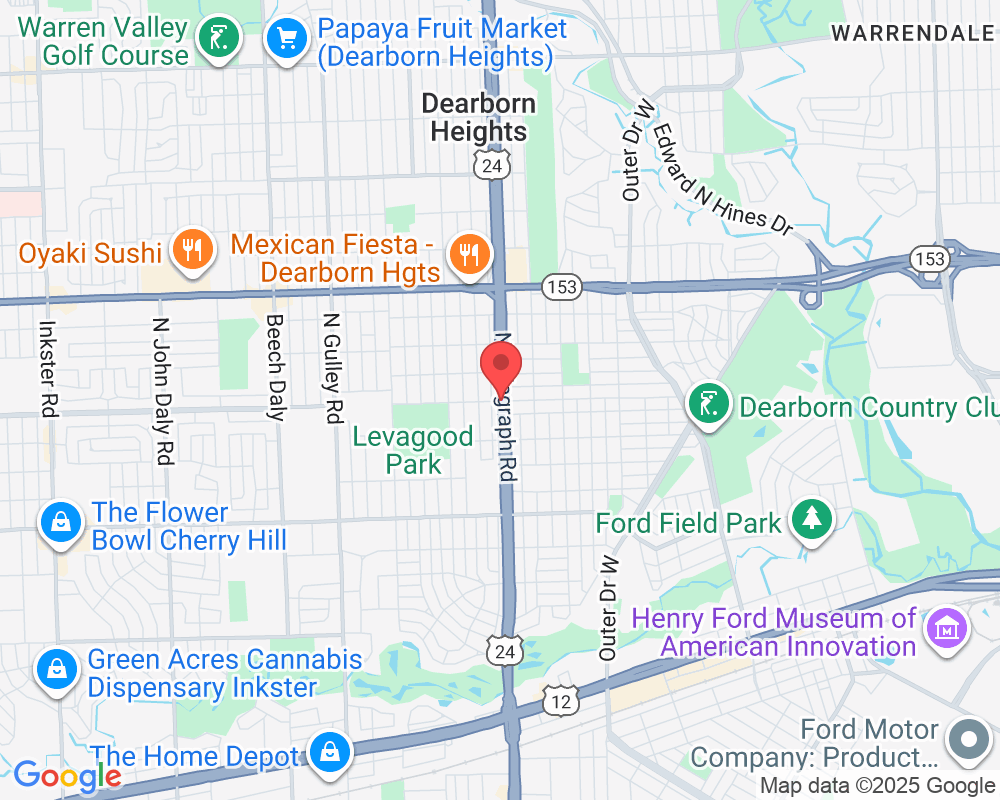

2018 N Telegraph Rd ste 6, Dearborn Michigan 48128

(313) 707-3344